What are the alternatives to Dramfunded? Could Nine Rivers Distillery have been possible with other approaches? If so, why was the choice for Dramfunded made? We explore all this and more below.

As a frame of context, it’s probably worth explaining how businesses are normally funded: They emerge from an idea, to a startup, and then on to an operational business resulting in, in some cases, a public listing. Don’t worry, we won’t get all nerdy about this. We’ll keep it simple and from OUR perspective, so before any investment experts pile in ranting about how we’re wrong, please remember that we’re humble whisky lovers, not investment bankers.

The Main Stages of Business Investment

From our point of view, we saw our key stages as being the following:

Pre-Seed. The first drop of money where a founder or founders would have some cash to put a concept together.

Seed rounds and beyond are where a founder or founders might reach out to friends, family and professional connections with a concept that needs funding to sprout. There is also a common trend to engage with professional investors such as angel investors, venture capitalist and eventually private equity. We’ll explain these in a moment.

The seed rounds are normally broken down into phases, called Series A, B, C and whatever other letters might be needed to distinguish different rounds of funding.

Series A might reach out to angel investors. Series B might include venture capital companies. Series C might include private equity. Angel investors typically work in the US$1-US$10 million range, and are usually prepared to take more risk for expected bigger returns. Venture capitalists typically work in the US$10-US$50 million range, investing in more established and proven businesses. Because the business has established footing, there is less risk and less return than an angel investor. Private Equity works with bigger numbers, lower returns, and expects to see a firmly established operation, perhaps a market leader or dominant brand.

How Things Worked At Nine Rivers Distillery

We started with a Pre-Seed investment round – this is where we pooled together some rambos (our term for RMB) to cover all the early costs. These costs included setting up a legal entity, paying for some lawyers to legalise our view on the company structure, shareholders agreements, renting and registering an office (all companies need a formal office in China – none of that PO box nonsense, or adding a letter to a home address to refer to a desk in a garden shed) and covering travel costs to travel the length and breadth of China to find a home for our project. If there was an alternative to dramfunded, it definitely wouldn’t have had such a cool origin story. Plus, we also used some money to register all our IP (intellectual property) which included trademarks and patents.

We then moved into the Seed Round, where all of our Pre-Seed investors threw in more money and we brought in more people with more money. We needed this to show the government here in Longyan that we were serious and that we had the money to bid for land. We put down a deposit and engaged with our architects to start designing our new home.

More lawyers, more legal costs, including a restructure (yup, first load of lawyers gave us the wrong advice), and we put Hayden Zou full time in Longyan to start moving things forward on a local level. With his cheerful demeanor and can-do attitude, he’s been rocking things in Longyan.

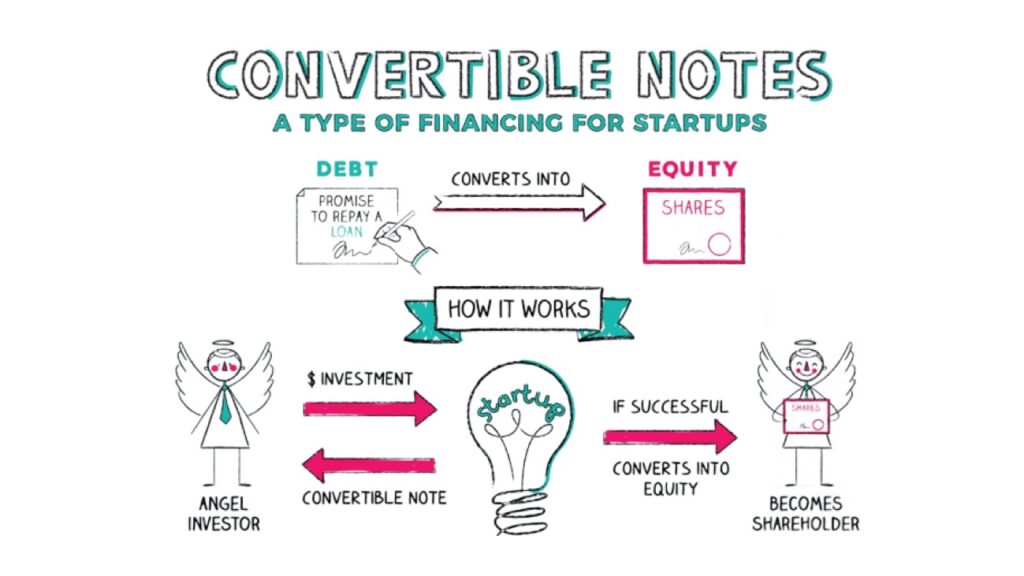

Logically, the next thing to do would have been to start a Series A round, but (although we needed more money) the project just wasn’t at the developmental level needed to start a Series A. So, instead, we did a couple of Convertible Note rounds.

A convertible note is similar to a loan and kinda like an investment. Investors throw in their money and earn an agreed rate of interest. The notes then have a clause where, at the start of an equity round (Series A) the note holder can either take back their money and the interest earned, or, convert them into Shares at the Series A round.

In Series A, we wanted to raise enough money to build the first 3 buildings of our distillery, purchase all the stills and other shiny things we needed to start producing, and get some spirit running off the stills. We worked out that we needed about ¥100 million and that would need about 1000 whisky lovers.

There’s some simple maths behind that number. The board have always funded 60% of the project, leaving the other 40% to be funded by micro-investor whisky lovers. We know the average investment from our whisky lover army, so a few button clicks on a calculator and bingo, we have a pretty accurate guess. Who said high school math was useless?

However, building up to 1000 people takes time, so rather than have everyone waiting for as long as it takes before they get their share certificate, we split our Series A into 4 phases, allowing us to essentially round closure and issue certificates, within months of investment, as opposed to waiting until everyone had chipped in.

Wait – Why No Professional Investors?

There almost were. We considered a few alternatives to our dramfunded approach. We had the calls and we did the meetings. Yet, it just wasn’t right for us at the time.

We won’t kiss and tell (it’s rather uncouth to do that after all), but the major difference is simply the massive void that we saw between their “knowledge” and our “experience”. While MBA’s, hand tailored suits, shiny shoes, and monologues full of buzz words and acronyms sound rather impressive, they don’t mean diddley if you don’t know China at a grass roots level.

Bringing a “branding and marketing expert” and showing some slides on a concept rebrand, inspired by a dozen click bait posts on LinkedIn (in which they argue that everyone in China loves the colour red because it’s lucky lucky lucky!) is not a “value add”…especially when the key message was that this “expert” would be billed to the company at the “amazing value rate” of US$5000 – per day! We weren’t expecting to have to PAY for alternatives to dramfunded!

Talking to a distillery start up with the opening line that you don’t drink whisky but you’re a “super dooper baller investment guru”, all while holding some green juice muck in a sleek designer cup because of some new age detox nonsense doesn’t really cut the mustard. If there’s not whisky in that cup, we are absolutely not entertaining it as a serious alternative to dramfunding.

Of course, we’re sure that not all professional investors are like this. We just have enough confidence in our project to believe there are profits for investors, which is why professionals didn’t win out over dramfunding. Ultimately, we’d like to see something a bit more interesting than fluff, waffle and noise for the sake of being heard.

(Note to any professional investors reading this – don’t task any wheatgrass-smoothie-swigging-suited buzz-word wobblers with contacting us. They will walk out emotionally and mentally battered. Get a normal, no nonsense, WHISKY DRINKER to get in touch…)

Industry Investors

It’s not uncommon for other big players in the industry to get involved in startup or early stage projects. In fact, the vast majority of distillery start-ups, despite their marketing fluff and waffle, are mostly only starting because they dream of a big-bucks cash out when one of the major players rock up with their army of suits and a cheque book.

Even us. Humble as we are with absolutely NO bragging whatsoever about this, we’ve had a number of approaches from some very big names in the industry (kinda rude to name them, but 2 very large baijiu producers and a rather well known Scotch whisky producer…) and enjoyed those conversations immensely. There’s zero shame in getting a kick out of a knock on the door when you’re nothing more than a slide deck and a muddy field.

One offer (one of the baijiu companies) was for a total buyout at double what we believed our value to be. Yes, even as just a slide deck and some mud. Flattering offer, but there was zero interest from all of us. Their second offer to buy 51% and retain full control over branding and marketing was met with a typically legendary outburst of mirth by the grey haired monster and the rest of the team. This was not going to be an alternative to dramfunded.

A second offer (the other baijiu company) was never going to go anywhere in our mindset. Ponying up their “head of whisky” who spent the entire call talking about their vision for whisky matured in Chinese yellow wine casks resulted in us pressing the mute key and rolling around on the floor in fits of laughter.

The old yellow wine cask maturation is a copy and paste from EVERY Chinese forum about whisky, where there’s a sheep level mentality about this being the best way to craft a “Chinese Whisky”. We think it’s nonsense. It would produce something vile and probably taste like a cheap vodka that has macerated rotten fruits, pencil shavings, and cigarette ash. Again, this was not offering alternatives to dramfunded.

As for the Scotch player, our first reaction was “what a bunch of dinosaurs”. With a mentality stuck back in the 1800’s their “vision” was to do what they have been doing for generations: the same old crap for the mass market, as their grandaddy’s grandad started.

In fact, calling them dinosaurs is a compliment. These people were from the Paleozoic era. Barely multicellular lifeforms. At least dinosaurs ran around with big scary teeth and gobbled up the smaller animals. The main armament of these guys was their ability to bore people to death. No surprise that we didn’t consider them as alternatives to dramfunded.

Again, we’re sure that not all of the industry players are so out of touch with reality, but until something a bit more in line with what we want to do, and more in touch with the fact that our calendar suggests we’re living in the 21st century and not the 19th century, then we’ll continue to do our thing with full independence from the major players. As it turns out, there really isn’t a good alternative to dramfunding.

(Note to any industry players. We have no interest in being an extension of your bulk spirits division. We’re doing single malt, we’re aiming for the top end of the market and we’re gonna shake up the global industry. If that’s “too ambitious” for you, then don’t waste your time, or ours.)

Whisky For The People By The People

So that’s why we are who we are, and why we continue to be dramfunded. Whisky lovers chipping in their coins, to have some skin in the game, and combine their bragging rights for being an owner, all while spreading the word about what we’re doing.

In a culture where word of mouth and personal recommendations are the major influencer in consumer interest and purchasing trends, we think we’re doing the right thing.

In a project where everyone invested actually loves whisky and wants to be fresh, raw, creative, and distinctive in a commitment to put quality before profit and greed – we think we’re approaching this exactly as it should be.

Whisky for the people, by the people.

Would You Like To Read More?

If you enjoyed reading about how we currently don’t see any alternatives to dramfunded, and you would like to catch up with some of our past articles, then please CLICK HERE and go to our News Section, where most of our other content is published.

Would You like To Know More About Helping Nine Rivers Distillery?

One of the easiest ways to help our project succeed is to take an interest in anything we have for sale. You can find out what we have if you CLICK HERE and go to our shop. We’ll make a few percentage points (after sales tax) and this goes directly to our project.

You could help us by simply buying your very own Brick for Life – a brick with a steel name plate wrapped around it, which will be cemented into The Plenum (our feature wall) in July 2023. Every brick owner is entitled to a free dram for life every time they visit us in Longyan, Fujian.

Or, you could learn more about being involved and help us grow to our target of 1000 stakeholders. You can read more about how we are Dramfunded if you CLICK HERE. Remember, we currently have no alternatives to dramfunded!

Follow Us

Last, but as important as all the other points above, you can help us by reading, liking and sharing our content across some of the more popular platforms.

LinkedIn users you can CLICK HERE to follow us.

Facebook users, you can CLICK HERE.

YouTube users, you can CLICK HERE.

Twitter users, you can CLICK HERE.

Instagram users, you can CLICK HERE.

This is just some extra blurb to help with the SEO for our article about alternatives to dramfunded